Net Present Value NPV Meaning, Formula, Calculations

As a result, projects or investments become less attractive because their potential profitability appears diminished when evaluated against a higher required rate of return. The time value of money is represented in the NPV formula by the discount rate, which might be a hurdle rate for a project based on a company’s cost of capital, such as the weighted average cost of capital (WACC). No matter how the discount rate is determined, a negative NPV shows that the expected rate of return will fall short of it, meaning that the project will not create value. Net Present Value (NPV) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. In this formula, i represents the required return or discount rate for the investment while t equals the number of time periods involved.

How is net present value calculated?

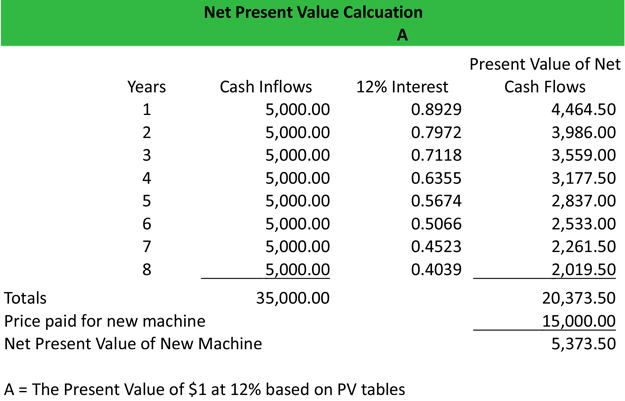

To value a business, an analyst will build a detailed discounted cash flow DCF model in Excel. This financial model will include all revenues, expenses, capital costs, and details of the business. It is sensitive to changes in estimates for future cash flows, salvage value and the cost of capital. NPV analysis is commonly coupled with sensitivity analysis and scenario analysis to see how the conclusion changes when there is a change in inputs. Net present value should be used together with other capital budgeting tools such as internal rate of return, payback period and profitability index. Consideration should be given to the capital rationing process which depends on the company’s capital budget.

NPV vs IRR

The US treasury example is considered to be the risk-free rate, and all other investments are measured by how much more risk they bear relative to that. Terminal cash flow, the cash flow that occur at the end of project equals the salvage value of equipment plus recoupment of working capital, sums up to $280,000. Find out the NPV and conclude whether this is a worthy investment for Hills Ltd. An NPV of zero means that a project or investment isn’t expected to produce significant gains or losses. Whether that’s acceptable or not is up to the individual making the investment decision. The NPV formula should tell you at a glance whether you’re likely to make money from an investment, lose money or break-even.

What is the NPV Formula?

- An NPV of zero means that a project or investment isn’t expected to produce significant gains or losses.

- Management can tell instantly whether a project or piece of equipment is worth pursuing by the fact that the NPV calculation is positive or negative.

- For this reason, payback periods calculated for longer-term investments have a greater potential for inaccuracy.

- This can help with decision-making when choosing investments for your portfolio or making strategic capital investments in a business.

- Imagine a company can invest in equipment that would cost $1 million and is expected to generate $25,000 a month in revenue for five years.

Depreciation is calculated based on straight-line method by dividing the depreciable amount ($530,000 – $150,000) by the useful life (4). As we note below that Alibaba will generate is accounts payable debit or credit a predictable positive Free Cash Flows. A positive NPV indicates a potentially viable investment, as it suggests that the project will generate more value than its cost.

Though the NPV formula estimates how much value a project will produce, it doesn’t show if it’s an efficient use of your investment dollars. Whether you’re making a big investment into your business, or looking to put investment funds into another organisation, the more information you have the better. Each of these appraisal tools provide different information that may put the investment in a better, or worse, light.

Example of NPV with a Single Cash Flow Investment

As with any tool, most investors use NPV along with other financial ratios and forms of analysis before deciding whether to purchase any asset. If you have questions about how NPV can be used as a part of an investment strategy, it may be worthwhile to consult with a financial professional. Unlike the NPV function in Excel – which assumes the time periods are equal – the XNPV function takes into account the specific dates that correspond to each cash flow. Performing NPV analysis is a practical method to determine the economic feasibility of undertaking a potential project or investment.

One of the primary advantages of NPV is its consideration of the time value of money, which ensures that cash flows are appropriately adjusted for their timing and value. In 2nd example, we will take the example of WACC (weighted average cost of capital) for calculating the NPV because, in WACC, we consider the weight of equity and debt also the cost of equity and debt. Businesses can use NPV when deciding between different projects while investors can use it to decide between different investment opportunities.

Below is an example of a DCF model from one of CFI’s financial modeling courses. If you need to be very precise in your calculation, it’s highly recommended to use XNPV instead of the regular function. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. To use this function, you’d simply create a new Excel spreadsheet, then navigate to the “Formulas” tab.